Approach and Guidelines for Climate Change

The Company's management philosophy is "Through our JINUSHI BUSINESS, we create safe real estate financial products and fulfill our part in protecting the assets of people throughout the world." Through our JINUSHI BUSINESS, we aim to contribute to the realization of a sustainable society. We recognize that climate change is an important management issue that will have a major impact on our business. Our policy is to actively work to resolve environmental and social issues, and to enhance disclosure of risks and opportunities.

Sustainability Governance System

The Company has established an ESG Committee and promotes ESG initiatives.

System and roles for ESG promotion

Board of Directors

Resolutions on various policies and targets related to ESG promotion, and matters related to various important measures

ESG Promotion Officer

In addition to handling the responsibilities of the Representative Director and President, the ESG Promotion Officer develops support for ESG promotion, and oversees the proposal and execution of policies, targets, and measures

ESG Promotion

Committee Examination and proposal of various policies and targets related to ESG promotion, as well as matters related to various important measures

Frequency of Committee meetings:At least once every six months

Chairperson:Representative Director and President

Constituent members:Appointed by the ESG Promotion Officer ESG

Secretariat:Finance Dept.

Risk Management System

-

With regard to our risk management system related to ESG, the ESG Committee engages in activities such as monitoring and examines countermeasures. Through cooperation with the Compliance and Risk Management Committee, which is chaired by the Company's Representative and President and is composed of Directors, heads of each depertment, etc., the ESG Committee formulates and implements the required countermeasures.

-

Details of deliberations, etc., by both committees are reported to the Board of Directors At least once every six months.

Strategy

Scenario analysis

-

Based on the framework recommended by the TCFD, we conducted scenario analysis on the impact of climate change on the Company's business.

-

The Company's business consists of our unique real estate investment method JINUSHI BUSINESS, in which we invest only in land without owning buildings. We examined transition/physical risks and opportunities, etc., in 2030 and 2050.

-

The Company conducts analysis based on the 1.5℃ scenario, which takes into account the achievement of the Paris Agreement and the realization of decarbonization, and the 4℃ scenario, which is the case in which climate change measures do not proceed sufficiently and natural disasters increase in severity.

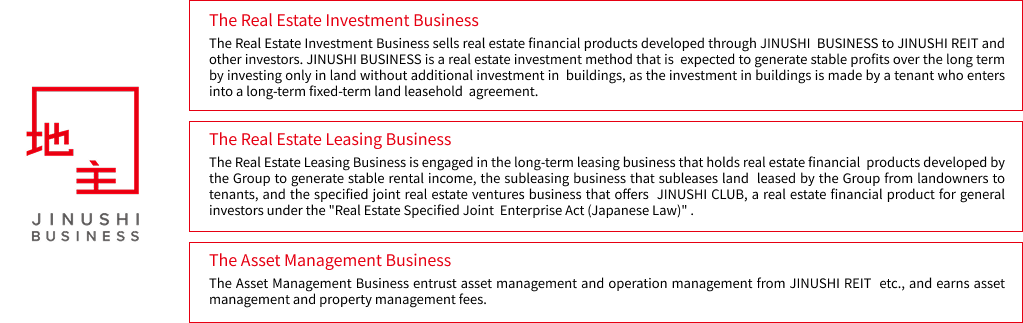

Composition of the Company's businesses

Scenario analysis

|

Scenario |

Scenario overview |

Main reference scenario |

|

|---|---|---|---|

|

Transition risks |

Physical risks |

||

|

1.5℃ Scenario |

A scenario in which regulations and policies aimed at achieving decarbonization are strengthened, climate change countermeasures progress, and the rise in temperatures from pre-industrial levels is limited to around 1.5℃. There is a strong demand for companies to respond to climate change and failure to do so will increase transition risks such as declining corporate value and loss of customers due to falling trust in the company. On the other hand, physical risk is relatively suppressed. |

IEA NZE2050 |

IPCC RCP2.6 |

|

4℃ Scenario |

A scenario in which sufficient climate change countermeasures are not taken and the rise in temperatures from pre-industrial levels reaches around 4℃. Physical risks rise due to the expected increase in the severity of natural disasters, rising sea levels, and extreme weather events. On the other hand, the transition risk is relatively low, as various regulations will not be strengthened. |

IEA STEPS |

IPCC RCP8.5 |

Risks and opportunities

- In regard to transition risks, physical risks, and opportunities brought to the JINUSHI BUSINESS by the transition to a decarbonized society and climate change from the perspective of likelihood and financial impact, we identified impacts as of 2030 and 2050 as shown in the following table, and conducted qualitative analysis of financial impact. Moving forward, we will examine quantitative calculations of the financial impact.

-

We were able to confirm that JINUSHI business, which invests only in land, is resilient to climate change and natural disasters, and has a certain level of resilience in both 1.5℃ and 4℃ scenarios.

|

Category |

Type |

Details |

Degree of financial impact |

Financial impact |

|||

|---|---|---|---|---|---|---|---|

|

4℃ |

1.5℃ |

||||||

|

2030 |

2050 |

2030 |

2050 |

||||

|

Transition risks |

Policies/regulations |

•Tightening of GHG (greenhouse gas) emission regulations, including the introduction of a carbon tax and strengthening of energy-saving standards |

small |

small |

small |

small |

• Increased costs of complying with regulations |

|

Technology and |

• Technological evolution; changes in tenant demand and market/store opening strategies due to climate change |

small |

medium |

small |

small |

• Decreasing ability of existing tenants to pay rent and decreasing tenant demand |

|

|

Physical risks |

Acute issues |

• Flood damage caused by typhoons, torrential rains, etc. |

small |

medium |

small |

small |

• Increased burden of response on tenants and increased frequency of store closures due to frequent occurrence of damage such as flooding |

|

Chronic issues |

• Increased risk of inundation due to rising sea levels and expansion of areas at risk of intensifying disasters |

small |

medium |

small |

medium |

• Decreased asset value of owned land |

|

|

opportunities |

Resource efficiency |

• Decreased construction process due to promotion of long-term contracts with tenants |

small |

small |

small |

medium |

• Increased affinity with JINUSHI BUSINESS, which prefers long-term contracts, and increased needs associated with store openings by tenants who consider cost efficiency |

|

Market |

• Occurrence of tenants conducting new businesses |

small |

small |

small |

medium |

• Acquisition of new tenant industries |

|

Countermeasures based on scenario analysis

- We aim to contribute to the realization of a carbon neutral society by 2050 by achieving carbon neutral for the Company's emissions and encouraging tenants to introduce environmentally-friendly equipment.

Expansion of JINUSHI BUSINESS

-

Purchase of land with low risk of natural disasters such as landslides and flooding

-

Reduction of GHG emissions associated with construction and demolition of tenants by concluding long-term contracts

-

Strengthening of ability to respond to environmental changes through diversification of tenant industries and expansion of business areas

-

JINUSHI LEASEBACK for existing land and building projects (promotion of long-term use of buildings by tenants)

Initiatives for reducing GHG emissions

-

Continuation of carbon neutral for the Company's emissions through utilization of renewable energy at the Company's sites, purchase of emissions credits, etc.

-

Continuation of activities that contribute to reducing environmental impact by adding ESG clauses to fixed-term land lease agreements with tenants

Targets and indicators

Targets

-

Continuation of carbon neutral (the Company's emissions amount: Scope 1, 2※1)

-

Rate of including ESG clauses in fixed-term land lease agreements with tenants※2 100%

indicators

GHG emissions

|

Classification |

Results for FY12/23 |

Results for FY12/24 |

2030 target |

2050 target |

|

|---|---|---|---|---|---|

|

Scope1※1 |

(+) |

27 |

25 |

carbon neutrality |

carbon neutrality |

| Scope2※1 |

(+) |

16 |

0 |

||

|

Purchase of emissions rights |

(-) |

▲43 |

▲25 |

||

|

Scope1,2※1total |

|

0(carbon neutrality) |

0(carbon neutrality) |

||

|

Scope3※1 |

(+) |

2,694 |

3,919 |

- |

- |

Other indicators

|

Classification |

Results for FY12/24 |

Results for FY12/25 |

2030 target |

2050 target |

|---|---|---|---|---|

|

Rate of including ESG clauses in fixed-term lease agreements with tenants※2 |

100% |

98% |

100% |

100% |

※1. Scope1:Direct GHG emissions from use at the Company (gasoline use in company cars, etc.)

Scope2:Indirect emissions associated with the use of electricity, heat, etc., used by the Company(power consumption at head office, branch offices, etc.)

Scope3:Emissions from other companies related to business activities (soil improvement work, demolition work, etc., by business partners)

※2. Application to contracts on or after June 9, 2022 that incorporate ESG clauses into the fixed-term land lease agreements template (applicable only to the Company's new development projects and domestic contracts)