"JINUSHI" refers to focusing on own land

without constructing any buildings.

Purchase land. Lease land. Sell the land being leased.

Management of the funds of investors.

JINUSHI BUSINESS is a new and unique real estate investment method in which we invest only in land and then utilize fixed-term land lease rights.

Four Steps of JINUSHI BUSINESS

STEP1Purchase land

Invest in land that is easily diverted for other uses

POINT

Appraisal ability for land

Even if a tenant vacates the property, we purchase land with high potential for diversion; for example, land for which it is easy to attract subsequent tenants or sell to a third party.

STEP2 Lease land

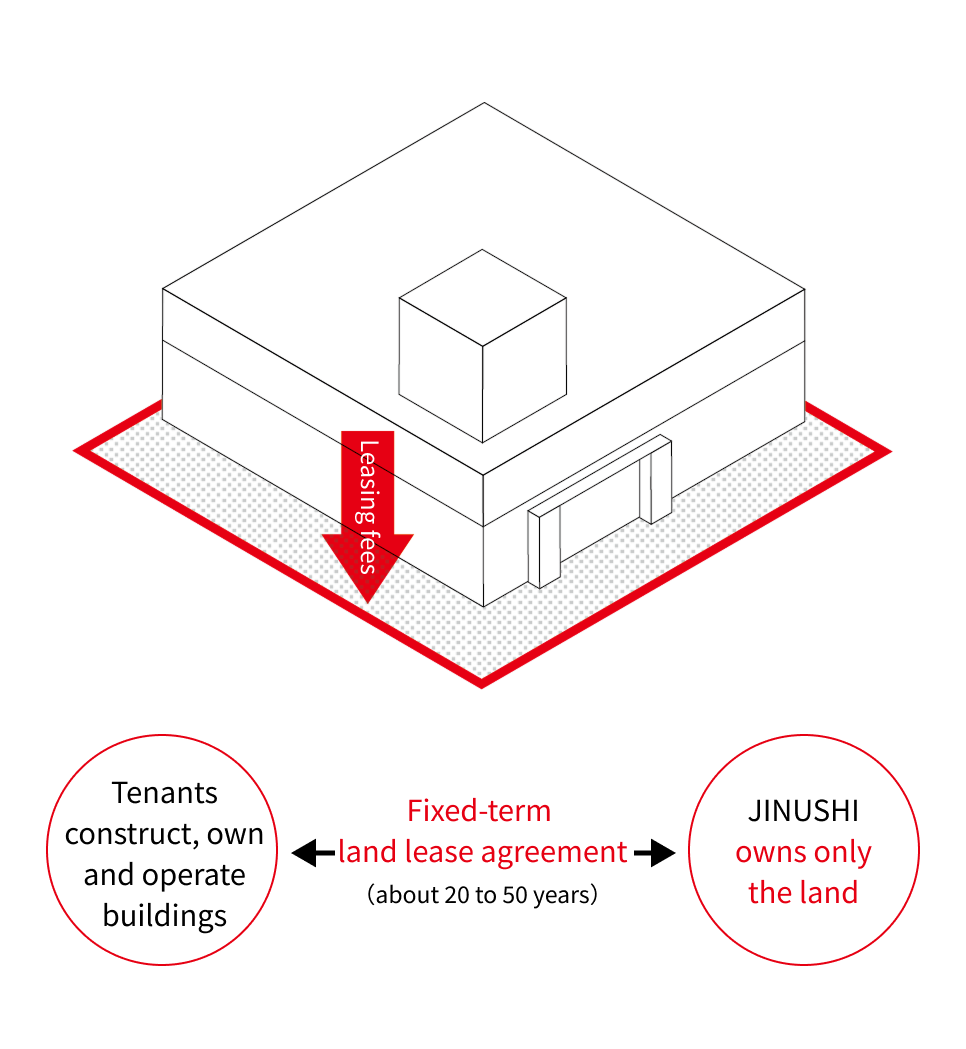

JINUSHI BUSINESS produces stable long-term income by executing contracts that define long-term fixed-term land lease rights with tenants; buildings are not owned by the lessor.

POINT

What is fixed-term land lease right that our company utilize?

What is fixed-term land lease right that our company utilize?

Fixed-term commercial land lease right (Articles 23) that our company utilize was enacted in 1992. Due to the revision of the Act on Land and Building Leases in 2008, duration of the land lease right was modified from "at least 10 but shorter than 20 years" to "at least 10 but shorter than 50 years," which could produce stable long-term income.

| Type of land lease right | Duration | |

|---|---|---|

| Land lease right | Land lease right of old Act on Land Leases and general land lease right(Articles 3) | More than 30 years |

| Fixed-term land lease right, etc. | Fixed-term land lease right(Articles 22)(Articles 22) | More than 50 years |

| Fixed-term commercial land lease right (Articles 23) | More than 10 years but less than 50 years | |

| Land lease right with special provisions for building transfer(Article 24 (1)) | More than 30 years | |

| Land lease right for the purpose of temporary use(Article 25) | ||

STEP3 Sell the land being leased

Sell to JINUSHI REIT, etc., as a safe real estate financial product that is expected to generate long-term stable cash flow.

POINT Track record of more than 25 years

Over the 25 years since our founding, we have worked on many JINUSHI businesses.

STEP4Management of investor funds

JINUSHI REIT is Japan's only private REIT specializing in leased land, providing long-term, stable asset management for institutional investors such as life and non-life insurance companies and pension funds.

In addition, through JINSUHI FUND and JINUSHI CLUB, we offer investment structures designed to meet the diverse needs of a wide range of investors.

POINT

Three strengths of JINUSHI BUSINESS

1) No need for additional investment

The only investment is for the land, and tenants pay for construction and ownership of buildings. Therefore, there is no need for any additional investment such as maintenance, repair, renovation, etc. maintenance, repair, renovation, etc.

2) Stable long-term income is expected

During the long-term contract period of 20 to 50 years, the tenant invests in buildings on the property. This reduces the risk of the property being vacated and creates expectations for stable long-term income.

3) Asset value is resistant to decline

Tenants are obligated to return a vacant lot. After the period of the fixed-term leasing contract expires, the land is returned as a vacant lot. This ensures that assets are returned at their maximum value. returned at their maximum value.

Features of Our Company

Specializing in ground leasing

We specialize in the "JINUSHI BUSINESS" and we are gathering information appropriate for "JINUSHI BUSINESS" so that our company comes to mind immediately when thinking about ground leasing.

Extensive development record

The "JINUSHI BUSINESS" has experience in handling a cumulative total of 487 projects amounting to about 636.8 billion yen*, thereby providing optimal investment opportunities for investors.

Proprietary network

We have established a proprietary network for our "JINUSHI BUSINESS" and built close relationships with tenants who possess a high level of creditworthiness.

JINUSHI REIT

Through the operation of JINUSHI REIT by JINUSHI Asset Management Co., Ltd., we constructed an integrated income model spanning from land procurement to sales and subsequent asset management.

*Note: Based on monetary value as of December 31, 2025